|

|

DUAL SIM PHONE MARKET

This article appeared by chance and as if by itself. I was working on Spillikins No 70, but the section about dual SIM phones suddenly turned into the separate article. I was influenced by Nokia’s foray into this segment. Unfortunately for the market leader its role has been already decided and we will discuss it as well. We viewed the topic at large and tried to analyze the prospects of such solutions and whether one day all phones will be equipped with two SIM cards. But let’s not be in a hurry.

The global market of dual SIM phones was born at the end of 2006 when Samsung launched the development of the model codenamed Pushkin, which could work with two SIM cards and targeted the market of the CIS and several other countries. A year ago a number of Chinese manufacturers proved that such phones could be created. Their products were unveiled at the World Mobile Congress in Barcelona, but failed to become popular and remained exotic even in China. At the time this niche needed a big push from one of the established producers, which could have convinced everybody that these products could be sought after and would not interfere with the operators’ interests. European operators were against as they feared that the second SIM card will be from direct rivals, which would definitely decrease their ARPU. Operators in Europe and the USA are the biggest phone buyers and no manufacturer could make them angry and go ahead with the projects. The Representative Office of Samsung in Russia managed to prove that such product could become viable and it was given the green light. One day I will write about the history of DUOS with many tragic, humorous and downright curious events. The first dual SIM phone to hit the shelves in Russia was offered by Fly. Its release date was postponed several times as the engineers tried until the very end to polish it up. The idea was suggested by one Korean top manager from Samsung at the party of the distributor (Euroset), where he shared the concept with the partner’s employee, who turned out to be from Fly. Fly began the race to introduce the model before Samsung and they managed to be the first by a couple of weeks. Taking into account different form factors and the price there was no head to head competition between the models.

Pushkin was called off when still under development, because the Russian Representative Office was not satisfied with the software to support dual SIM features. Finally D880 Duos was launched in October 2007 and immediately became one of the most popular new products worldwide. 2 weeks after the sales started it was available in the USA, Canada and Europe. Its high price of $550 did not deter the consumers as they needed such functions. The operators were particularly enraged by the plans of Samsung to develop numerous models in different price ranges and target different demographic groups (women, young adults, people engaged in sports). This project has been put on hold because Samsung not only saw the potential in this niche, but managed to measure it. The results were far behind the initial forecasts. Samsung decided to control at least 50% of dual SIM phones markets where the company was active. China was not on the list. Samsung supposed that the big players (Motorola, Nokia, and Sony Ericsson) had closer ties with the operators and could not follow suit at least in the short term period, which would allow Samsung to get a foothold in this segment. In 2007 Samsung was less popular and did not have many agreements with European mobile operators.

Samsung played its cards with dual SIM phones quite well. New price segments had to be penetrated downwards. Every next model had to become cheaper than the previous. This strategy still works and the cheapest handset Samsung C3212 costs around ˆ90. In three years the company went from ˆ400 segment to ˆ90 and continues to move down.

In 2007 Samsung expected the Chinese manufacturers to come up with dual SIM solutions within 6 to 8 months and this market had to explode in 2009. The forecast was correct as well as the assumptions that such players would offer affordable handsets and would not directly compete with DUOS models from Samsung. At the same time the price of chipsets for such phones became equal to those used in ordinary models, which allowed certain niche players, for example Fly, to produce dual SIM phones only. Unlike in Russia in Europe the company is almost unknown and does not operate there. Philips also started producing similar phones and LG is active here as well, because it always follows Samsung and copies the features of its phones.

Why Samsung did not compete with the Chinese manufacturers in the low end price segment? The company believed that the proliferation of such phones would play into its hands. The Chinese companies are present only in its domestic market and in 2008-2009 could not threaten Samsung by any means. In 2010 after their expansion strategy became obvious Samsung offered cheaper models, which surpass Chinese handsets by providing the guarantee, service and sometimes better features. This year the company will increase its presence in the segment with telephones priced at ˆ35 (retail price for the analogue of E1180 by the end of the year). Nothing threatens the plans of Samsung to retain at least 50% of the market in separate countries.

The success of Samsung strategy was confirmed by Nokia foray into the segment starting with the 4th quarter of 2010. Samsung has planned the game well in advance and Nokia not only will have to make up the lost ground, but follow the rules imposed by others. This battle will be lost even before it begins.

In 2009 Nokia was concerned with DUOS success and started cautiously asking the operators if they favored such phones. One of the proposed ideas was the use of SIM cards of one operator only, but nobody treated it seriously. First public discussions of dual SIM phones started on Nokia’s blog. You can read the commentaries. They are quite illustrative.

The majority of consumers clearly indicated that they needed midmarket and high end models, because they got used to such solutions. Nobody mentioned budget phones, but Nokia could not enter the market and directly compete with Samsung and other manufacturers. It would not be able to be successful, especially at the beginning and it would put the market leader in a difficult situation. The second reason for Nokia to start with the budget phones was the sensational expansion of Chinese dual SIM phones in other countries. This unofficial distribution began to influence Nokia’s business. For example in Africa and Middle East Chinese handsets with two SIM cards and good features priced between $50 and $150 became quite popular. They have no guarantee and service, but win in good features and competitive prices. Such models are sold not in hundreds, but thousands. In China they are sold in millions. These products cannot stay behind the Great Wall and go elsewhere. Nokia suffers the most, because it is well represented in developing nations with its low end and midmarket solutions. The average Nokia phone costs ˆ62. In 2009 the Chinese companies offered 2400 dual SIM models and this growth will go on.

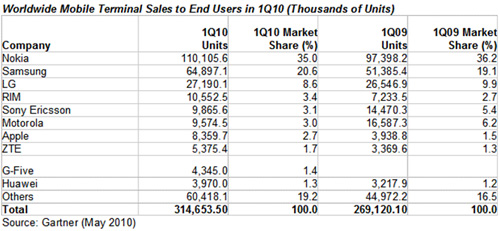

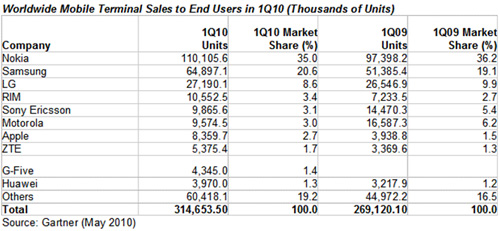

Do you want a specific example? Look at the sales figures worldwide during the 1st quarter of 2010 (Gartner).

Pay attention to the company G-Five from Hong Kong (often called “give me five”, which is an interesting name). It appeared from nowhere and sold almost 4.5 million phones. Would you like to know what do they produce? Dual SIM models. The description of these phones is available from the manufacturer’s website.

Nokia becomes the latest newcomer in the dual SIM phones market

Nokia strategy lies in the protection of its budget models from the Chinese manufacturers and then they plan to go up until the company offers dual SIM phones in all price segments and not to compete with Samsung from the very beginning. This position is weak as Samsung has already reaped the main benefits by offering expensive solutions. On the other hand good brand perception will help Nokia to sell such models successfully. This is only theory as in real life it will hit hard the sales of Nokia itself. Many of its loyal customers use two phones at a time and if offered high quality Nokia models in midmarket or high end segment with two SIM cards they would happily embrace such innovations, but it will kill the sales of other models. To add insult to injury Nokia is under pressure from operators reluctant to back the distribution of such products in developed countries. They were even announced in Kenya and will be available in Africa, Eastern Europe and Latin America. No Europe, please! Nokia does not want to irritate the operators, because it is currently carrying out difficult negotiations with them about the range for 2011. These talks are vital for Nokia at the moment and it will not risk its future for a small niche. Other models are doubtful and during the next two years the company will not introduce dual SIM phones above ˆ180 to ˆ200 range. These products will be available on the limited number of markets anyway.

This decision is also questionable because the newly launched dual SIM Nokia C1-00 does not support the simultaneous use of two cards. Priced at ˆ30 this model is an analogue of Chinese products or cheapest handsets from Fly in Russia, which support the simultaneous use of two cards. This model is destined for failure, though some people will buy it as a simple low end solution. Mass consumers will not use it with two SIM cards. Unfortunately, the company is enthralled by illusions and impressions from 3 or 4 years ago when the appropriate market research was carried out and in developing nations one phone could be used by many family members. Today the situation is different due to efforts of Nokia and other manufacturers. Every person either has a phone or wants to have it. Those who have no money for the second phone will not buy the second SIM card either. In other words C1-00 is so specific and artificial that the introduction of this handset cannot be justified. Nokia just wanted to stand out and offered the “innovation” from the era of Benefon Twin. Was it really necessary?

Nokia C1-00 is not part of the dual SIM phones market, but is just a budget handset. Nokia C2-00 is a different story and is really the first Nokia with the support of two SIM cards. Its price in the 4th quarter of 2010 will be ˆ45. Similar model from Samsung will appear at the same time on various markets and will cost ˆ35. Game over! The performance prepared by Samsung as far back as 2007 is being played by the rules of the genre. In this situation Nokia is not the pacesetter, it does not play its own game, is not sure what sales to expect, has no experience in the area and when it wants to compete on price the competitors can easily upset its plans. Marketing solutions from Nokia are quite weak and the research proves that its strategy is just wishful thinking. The company lives in a fool’s paradise and makes silly mistakes, albeit in this tiny segment. The power of the brand will help Nokia to get a foothold in the market, but it will not be a major player. It will either lose out to the Chinese manufacturers or will stay on par with them. It principally applies to developing nations.

Prospects for the dual SIM phones market

Samsung strategy to control no less than 50% of the market (not taking into account the Chinese manufacturers) does not require big number of models, but needs to embrace all price ranges (ˆ35 to ˆ350). This will happen in 2011 and afterwards we will see only the updated models as the old ones end their lifecycle. LG will follow Samsung and its portfolio will feature many dual SIM phones.

The main growth factor will be China and local manufacturers, because almost all phones come with two SIM cards. Their outward expansion will initially affect the emerging markets, where the operators are weak or cannot block the sales of such devices. Then we should not ignore the unofficial channels for phones distribution in all countries and if the operators do not fight with such handsets with the help of IMEI their spread will continue. The maximum capacity of any market for uncertified models hovers around 5% of sales (China is an exception). Officially or not European markets will target such indicators.

When the price of handsets with one or two radio modules is the same the Chinese manufacturers will always choose the second option. The similar approach has been also adopted by Fly and Philips. Major producers cannot follow this example. If they produce dual SIM phones in big numbers it will affect the sales of regular models. Neither Nokia nor Samsung are ready to do it. The competition will be confined to this limited 5% niche. Other players are unlikely to be active, for example Sony Ericsson is developing such a model (midmarket handset), but is not sure if there is enough demand.

The Chinese companies do not have such limitations and will try to use their advantage. They have other problems, because models from China cannot be certified in the majority of countries (as they use banned technologies, for example lead soldering), breach patent legislation at times, etc. To solve these issues the rapidly growing Chinese manufacturers will require at least 4 or 5 years. Until then they can enter only the emerging markets.

In terms of products the next breakthrough can be Android smartphones with two SIM cards offered by large manufacturers strong enough to attract attention and have good sales. Who will be the first - Samsung or HTC is still an open ended question. Both companies are weighing their options and see opportunities here. But it should not be expected in the near future.

In my opinion the segment of dual SIM phones will remain stable without any dramatic fluctuations of popularity. New models will become more feature rich, but this an evolutionary process. I hope that this article provided you with the necessary insight into the niche. If you like this material and would like to join the discussion, feel free to comment on our forum.

Do you want to talk about this? Please, go to our Forum and let your opinion to be known to the author and everybody else.

Related links

Eldar Murtazin (eldar@mobile-review.com)

Twitter Twitter

Livejournal Livejournal

Translated by Maxim Antonenko (maxantonenko@ukr.net)

Published — 08 June 2010

Have something to add?! Write us... eldar@mobile-review.com

|

News:

[ 31-07 16:21 ]Sir Jony Ive: Apple Isn't In It For The Money

[ 31-07 13:34 ]Video: Nokia Designer Interviews

[ 31-07 13:10 ]RIM To Layoff 3,000 More Employees

[ 30-07 20:59 ]Video: iPhone 5 Housing Shown Off

[ 30-07 19:12 ]Android Fortunes Decline In U.S.

[ 25-07 16:18 ]Why Apple Is Suing Samsung?

[ 25-07 15:53 ]A Few Choice Quotes About Apple ... By Samsung

[ 23-07 20:25 ]Russian iOS Hacker Calls It A Day

[ 23-07 17:40 ]Video: It's Still Not Out, But Galaxy Note 10.1 Gets An Ad

[ 19-07 19:10 ]Another Loss For Nokia: $1 Billion Down In Q2

[ 19-07 17:22 ]British Judge Orders Apple To Run Ads Saying Samsung Did Not Copy Them

[ 19-07 16:57 ]iPhone 5 To Feature Nano-SIM Cards

[ 18-07 14:20 ]What The iPad Could Have Looked Like ...

[ 18-07 13:25 ]App Store Hack Is Still Going Strong Despite Apple's Best Efforts

[ 13-07 12:34 ]Infographic: The (Hypothetical) Sale Of RIM

[ 13-07 11:10 ]Video: iPhone Hacker Makes In-App Purchases Free

[ 12-07 19:50 ]iPhone 5 Images Leak Again

[ 12-07 17:51 ]Android Takes 50%+ Of U.S. And Europe

[ 11-07 16:02 ]Apple Involved In 60% Of Patent Suits

[ 11-07 13:14 ]Video: Kindle Fire Gets A Jelly Bean

Subscribe

|