|

|

Print this review

MP3-players – Global markets

Editor-in-Chief’s word. This issue opens a series of analytical articles devoted to the market of portable players, namely PMP-devices, which are capable of playing back both music and video. Since the field we have just mentioned appears to be exceedingly diverse, we have divided the main article into several subject-based issues and today you have the chance to read the one coming first. As a matter of fact, it is the first time an article of this depth occurs in the mainstream press, being available to anyone, and that only doubles our pleasure of publishing it here.

MP3-player, or to be more precise portable compressed-content-player, is the very top stage of 34-year evolution of audio devices.

Some might call them “black sheeps” and there won’t be much of a mistake – the history of these gadgets stands alone, dropping out of seemingly justified and proven “Cassette player -> CD player” family tree. A number of factors having both market and anti-market aspects in them have granted the modern industry of MP3-players and similar devices the unique face.

The reasons stated below can be considered as the most dominant ones:

Being a technologically advanced device, an MP3-player is still a multi-purpose gadget with wide-availability, cheap components and rather unsophisticated design. All this has ensured low price of “entrance ticket” and allowed enormous manufacturer to establish own product-lines.

At a Chinese MP3-factory. Photo by www.imp3.net

Spontaneous gain of popularity by MP3 music format, as well as its closest rivals. Unlike cassettes or CD disks, compressed audio formats were not hyped by global corporations – on the contrary, it was a bottom-up process, which has ended up being one of the most notable achievements of Internet-culture. In the end the market’s largest players like Sony, Panasonic and Philips, which had already used to having all new trends under their thumbs, failed to react in the proper way and lost control over the market.

Piracy. The first official reaction of sound recording industry to the announcement of the world’s first MP3-player in 1998 was a suit brought by RIAA against the developers of that gadget, Diamond Multimedia. And ever since that moment the war between content creators and systems working on distribution (be it legal or not) hasn’t stopped even for a second.

A satirical poster making fun of RIAA’s methods of coping with piracy.

In fact, court actions were taken against digital formats themselves, compatible players and web-services, providing access to digital content – combined with the previously mentioned factor, it paralyzed the will of many global corporations to promote and launch MP3-devices and this hesitation was just enough to let new players get hold of the best shares.

These three factors have forged the present MP3 market and continue attuning it even nowadays by adding completely new, peculiarities, unseen before, which are:

Huge amount of players, majority of which are so called startup companies, in other words, young and still growing IT-companies, while global corporations with own traditions and methods have almost fallen into oblivion – against the background of Sony, Panasonic and suchlike, even Apple is a “startup”, which made its debut 5 years ago and still doesn’t have own factories. The most obvious consequence of such state of affairs is chaotic character and suddenness of the market – companies pop up and disappear every day with only Apple Samsung being somewhat stable. Other players tend to have ups and downs regularly, which significantly affects the balance of forces.

Heterogeneity of the market. Recently established “startups” as a rule don’t have what it takes to promote products all over the world and thus are forced to deal with only one or a couple of local markets. This has lead to a very uncertain pattern of the today’s global market – basically, there are at least 10 local markets on the globe with own dominating players and individual ways of the industry’s development. No doubt, other industries have their own kinds of regions differentiation (for example Motorola prevails on the US cellular market), but only a little can show off something similar.

Prevalence of OEM. Being weak in both marketing and financial aspects of business, manufacturers have nothing to do but turn to other companies’ brands in order to boost their products on foreign markets. But the problem is actually two-fold – a lot of known and “so-so” companies wouldn’t miss the chance to amplify their proposals with MP3-players without spending any resources on research and development. Thus OEM-coalitions are even more than inevitable, which implies that one and the same model might appear under different brands and codenames in various countries, or even have a couple of names in one region.

OEM in action:

MSI Mega Player 538 and Rovermedia Aria M1

Powerman XL810 and DaZed V-73

DMTech DM-AV10 and Direc MF7010F

Serious pressure, put upon the market by substitutes. When experts forecast that a certain class of portable devices (cameras, MP3-players, PDAs) will get wiped by multi-purpose rivals, they place emphasis on ease of use and lower overall price, however these are psychological and marketing factors that are left out, whereas they might be the most influential when it comes to mass market. And today, when large companies running famous brands cannot cope with the ever-growing MP3 market and propose own solutions, while minor manufacturers are not the ones to rely on, unsophisticated users get lost in the labyrinth of this market. Vast variety of models and available form-factors make everyone think that in reality an MP3-player might look even in the most incredible way, or be implemented into nearly any device. Therefore, without own grandees and distinctive looks, this market is more vulnerable to influence of substitute devices than any other one.

Variety of hardware solutions. At present there are ten or so different hardware platforms, powering MP3-players and nearly the same amount is applied only on high profile devices. Under the pressure of glut on the market, substitutes and tightest price competition, manufacturers have nothing left to do but look for really credible and original solutions. As a result MP3-palyers considerably vary not only price-wise (from 10 to 1000 USD) but also in terms of design; but that is not all – companies are putting loads of efforts into embedding advanced technologies in their models, namely WiFi is made use of by Archos, Microsoft, Commodore, MusicGremlin, DMB-enabled devices are already at disposal of numerous Korean companies, MSI arms its players with U3 protocol, etc.

Undoubtedly, all these key aspects are to be taken account of in order to get a better idea of the modern global portable audio market’s pattern. Having said all that, we are ready to get down to details.

Peculiarities of local markets

The MP3-players market, as we see it today, is a very uncertain environment, where local markets have own unique faces and peculiarities. Even though it might look simple at a glance, the list of differences includes not only major players, but prevalence and integration level of certain technologies, ways of positioning and advertising, consumers’ preferences and a lot more.

Obviously, this makes difficulties for analyzing the global market, as value of talks on shares of given brands, ups and downs and world-wide tendencies is somewhere between slim and nil.

Meanwhile, statistical information on the global market is not easy to access at all and at that contains loads of controversies – for instance, volume of world-wide sales in 2005, according to many trustworthy sources ranges from 50 to 140 mln. units. Of course, one might say that such gap is the result of obscure definition of portable audio – some count only Flash and HDD-devices, others tend to add CD-MP3 ones, while the rest think that Audio-CD and cassette players will do as well. But in the end, these amendments can’t make up for such discrepancy. At any rate, substituted data allows us to assume that around 100 mln. portable digital audio-devices were sold in 2005.

Approximately 22 mln. units, or 22% if you like, were manufactured by Apple. The statements, that have recently flooded into the web, featuring 70-, 80- or even 92-percent share of iPod hold true only for the American market and in some ways demonstrate depth of geographical differences in the world. Nevertheless, that brand appreciably stands out against the background of other trademarks pretending to being global ones, as it has everything what it takes: reputation, prevalence, and thus significant shares on most of local markets. Samsung, Creative, iriver, Sony, iAudio are widespread, but cannot boast big market shares yet, whereas many consumers are not aware of such brands as iriver and iAudio.

Brief review of global brands

Apple iPod (USA)

iPod brand will get a close-up when we will be making an overview of the American market, however it is not only the US, where Apple trademark has forged into the lead – the UK and Japan are also on the shortlist. In the rest of regions, this brand has got fine shares (10-30%) but is not capable of domination over the entire local market.

The difference between “iPod-regions” and “non-iPod-regions”, depends mostly on Apple’s aims for each country – should it be on the company’s priority list, that local market will see a massive advertising campaign, localized iTunes Internet-store and finally, aggressive pricing policy coming from Apple. The example of Japan clearly displays that frequently these steps are more than enough to occupy 50% market share. In a nutshell, it seems that Apple can easily make it to the leading spots on almost any market (saving for a few Asian ones), but apparently, the company feels good about its current position.

Samsung (South Korea)

While Apple is the world’s strongest manufacturer, Samsung acts as a runner-up in this ranking – in fact, this is the only huge trans-national corporation, successful with MP3-players. It’s caused mainly by the fact that the company managed to make an appearance on this market in one of the very first waves with its Yepp brand back in 1999. A crucial factor is also Samsung’s leadership in production of majority of components – flash-memory and displays in the first place. The field of hardware platforms is also considered by the company as a perspective area, for Samsung develops it rapidly –the manufacturer is planning on making it to the leaders there as well.

Being a forge for specialists in Korea has already played a part in the company’s success –top-level engineers and developers of many Korean startups came from Samsung, and what is more, their own companies continued having close relationships with the “alma mater”. Such partnership had eventually led to advent of numerous joint OEM and ODM projects, which laid the foundation for the Korean giant’s firm position.

Unlike a number of rivals, Samsung is carrying out an intensive policy – its current strategy is quite similar to that we see coming from it in other fields of industry: development of a wide and original line-up, proposition of an attractive price/quality ratio and aggressive advertising campaigns.

All these models were announced by Samsung during the first half of 2006.

At that Samsung proves to be flexible enough to combine such things as adopting fetching solutions by its competitors (for example, iPod Nano – the YP-Z5) and self-made developments. The company’s product line features devices residing in most of price-brackets and form-factors – from unsophisticated Flash-powered players to feature-packed PMP running on hard drives. The main focus is currently on Flash-players, though, since the company sees the future in it; in light of this fact the division specializing on hard drive-based MP3 players was recently shut down, all developments – frozen.

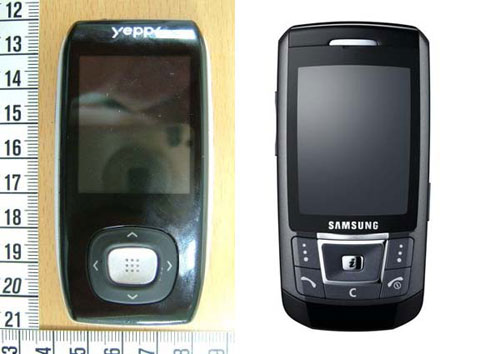

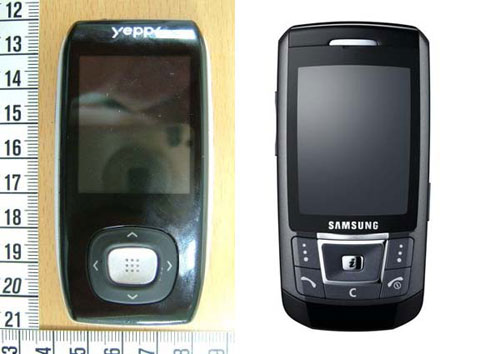

Over the recent times Samsung has tended to bring together MP3-players and handsets design-wise. Model YP-T8 to some extent retains curves and shapes of the sliding flagships - the D500 and senior models. The most recent YP-T9 exposes that trend even further, as one of the today’s most groundbreaking motifs, minor thickness, is one of the device’s main highlights. The reasons of such strategy may vary – from the hunger for boosting sales owing to a well-known design, to creating a unified image of Samsung’s products in consumers’ minds.

MP3-player YP-T9 (an exclusive photo by engadget.com) and the D900 handset.

The corporation sets out to claim the leadership on this market and while in some regions (the US, for instance) such goals are far from being achieved, Samsung has gotten a hold of significant shares in certain South-Eastern Asian countries, in the Middle East, in Russia and on some European markets.

The company’s attitude deserves a special credit, as unlike Creative or iriver, Samsung isn’t in the habit of rushing for the US market with swords drawn and telling about its aims to “kill iPod” – on the contrary, Samsung prefers doing to lofty phrases.

For example, lately there has been a lot of hype around the company’s intentions of establishing an own online-service, enabling customers to purchase music and other content. Samsung has already signed with MusicNet dealing with online music trading – the newly acquired partner will be ensuring availability of Samsung’s services in Europe.

Creative (Singapore)

At the moment the company is going through not the best times. There has been a major drop in sales of sound cards during this year, so that MP3-players are generating most of the income for the company. Further more, Creative’s world-wide shares are falling down as well – the company is currently failing to cope with competition on the markets in Asia and North America. The last “bastion” is continental Europe, where Creative’s cheap flash-players never get out of top-sales charts.

History-wise, the company was one of the pioneers on the MP3 market and also embedded many technical innovations faster than many other players (hard drives, microdrive-based players), however in terms of design and positioning it was “Apple’s shadow” path that Creative has stepped onto. Nevertheless a strategy “get a competitor’s product, now add some features and lower the price” that has proved to be a justified on the market of sound cards, just didn’t work out here. Over five years of striving, the company hasn’t managed to follow up or even get close enough to iPod’s success. Huge, for Creative of course, investments into advertising couldn’t save the day either. This loss in an exhausting rivalry has left the company in a pathetic state and even the recent court victory over Apple isn’t likely to clear up the company’s obscure future. While 100 mln. USD, which the American company is to pay, cannot cover the losses Creative suffered in the past three quarters, for Apple that amount of money is nothing more, but a slightly less value than weekly income generated by iPod alone. The latest decision of the Singaporean company to join up with “Made for iPod” accessories club can be considered as a disguised act of capitulation.

One of traditional complaints lodged against the company is an inflated line-up. Undoubtedly, such policy in itself won’t do much damage – Samsung, for example, proposes a lot of models as well. However Creative’s announcements are somewhat chaotic, models frequently get to compete with each other and thus dissolve the company’s market share even further. On the face of it, Creative has a rich line-up, featuring solutions coming from various price-brackets – from the cheapest Flash-players to HDD-PMP powerhouses. But at that consumers have been offered the same Muvo players under different titles for nearly five years now; the only adequate PMP got updated only after a year of sales, and thus a device armed with a wide 4,3” display and USB Host by Creative was eventually released at the time when Korean companies had been proposing that solution for nearly one year.

The highly anticipated Zen Vision W îò Creative was a year late

The company keeps going on with sales of mediocre models like Zen Sleek Photo, which moved to the class of outdated devices right after the launch of iPod 5G. Nonetheless iPod Nano has many assassins created by Creative: a “HDD-veteran” Zen Micro Photo, new Flash-players Zen V and Zen Neeon 2. All these aim at one and the same niche – portable player with a color display and capacious storage, which is Creative’s usual manner of presenting new solutions over the past few years.

Trio of iPod-killers by Creative

iriver (South Korea)

Apparently, iriver and Creative are in the same boat today, as both are experiencing financial difficulties and on top of that, the causes here and there are pretty much the same – overestimated ambitions had incited the company to a direct confrontation with Apple, which ended up in huge financial and share losses for iriver. When the company was at its peak, it occupied up to 13% of the entire American market - for comparison, now it can only fit “Others”, even though the main aim has been maintaining and increasing shares on this very market. Europe also isn’t iriver’s best region – the company isn’t capable of vying with Korean manufacturers, selling their devices under local brands. Furthermore, on its home Korean market the company’s share is falling under the pressure of Samsung and iAudio.

In the year of 2005, iriver committed several faulty actions regarding the product policy. One of them was an attempt to prolong the success of the h10 by launching its clones, both bigger and smaller ones, armed with Flash memory and 1.8” hard drive. However, that design has turned out to be “nonscalable”, since neither the h10 junior nor the h10 20GB adopted popularity of the “device-in-the-middle”.

Three h10 “brothers in arms”. The market hasn’t accepted the attempt to sell one and the same thing three times in a row.

At the same time no fresh iriver’s proposals had been announced for higher price-brackets with capacious MP3- and Flash-players in them and as a result the company lost these niches. A new T line-up gained a very limited success, as it showed off no all-round new features and mainly made use of Samsung’s solutions. Nevertheless model U10 appeared to be extremely fetching and could have become a real break-through, if only there wasn’t just a small snug – for reasons still unknown, iriver kept equipping the U10 with miserable (for such device) storages in course of a year – 512 Mb and 1 Gb – against iPod Nano’s 2 and 4 Gb respectively. As a consequence of that, the enormous potential possessed by this devices, hasn’t been made use of.

U10 – this model deserved more…

The announced models -– e10 and n20 – are second-rate and therefore deserve a little attention. The company’s credo of a leader in technologies is obviously fading away: the iriver’s line-up still proposes Flash-powered models with only 4 Gb onboard, whereas even minor Korean and Chinese companies have the same ones in their portfolio. One-inch hard drive on the e10 is an anachronism in itself, while 6 Gb of storage against possibility of expanding to 12 Gb and availability of 8 Gb models by Mpio è Creative, look really pathetic. A “top-notch feature” empowering the player to double as a TV’s remote control, found on the e10 has already been around for more than 2 years owing to a Korean company, going by the name of Mcody. Another evidence of idea crisis within the company is continued use of one and the same design concept – necklace-looking casing of the n10 (n11, n12).

Today iriver is publicly reporting about its intentions of leaving the MP3-market and switching to less competitive and more profitable markets – possible variants are gaming consoles, including the ones with WiBro wireless connectivity, PMPs enhanced with DMB receivers, and electronic interpreters. However none of these ideas has yet gone beyond prototype editions. Moreover, iriver has already missed the chance to take the lead on the PMP-market – over the past two years, it got flooded with new strong players, like Digital Cube. Digital television is not a groundbreaking thing for Korea anymore, and should iriver try to invade markets outside the peninsula, it will definitely encounter incompatibility of standards. The market of gaming consoles has its authorities as well, such as Sony and Nintendo. The future of WiBro outside Korea is still undecided, and the path of Nokia N-gage clearly displays all reefs accompanying incorporation of wireless gaming services.

DMB-players, electronic interpreters – these are the fields, where iriver is trying to redeem itself.

Thus iriver is running risks of being knocked out of the MP3 market and not having opportunities to get into a new one. Taking account of the company’s desperate financial status, even its web-services, so popular in Korea, might not help it to survive.

Sony (Japan)

To get a definitive idea of what a sorry sight Sony currently is, just think of its remarkable achievements in the past and the brand’s weight. The truth is – the way Sony has lost control over the portable audio market is worth getting into courses of marketing. And since the most of its share has been grabbed by Apple, analyzing the factors that have led to such outcome would make sense.

First, Sony made it hopelessly late to the MP3-players market – it went in for this field only in 2005 (the first MP3-player was released in 1998, first iPod – in 2001). By that time, the market had already been shared, at that the “legendary brand” of Sony couldn’t make all the difference for an MP3-players. In the world of global networks, computers and information technologies, consumers have gotten used to new brands: Microsoft, Apple, Dell, Google etc. – these are not the buzz words anymore; on the contrary – they are well-known to each and every one.

Second, all Sony’s efforts in terms of design were mostly chaotic, which led to a whole lot of models arranged in an illogical succession-less line-up. Some concepts had better luck, some – poorer, but the very fact of such mess implied that a solid image of Sony Walkman player as a bearer of a distinctive style just could not emerge. In different models Sony applied different materials and controls, which made the whole situation even worse.

Sony’s HDD-players have various looks.

Similarly to iPods, Sony-branded players have only the very minimum of functions onboard. However Walkman’s image as a brand couldn’t match that of Apple’s solutions, at that consumers could extend iPod’s feature set by purchasing special accessories. And while the latest generation of Apple’s players deals with video playback, Sony’s devices don’t have even a color display nowadays – that’s the way how Sony has doomed itself to being an outsider technology-wise even when compared to iPod, which is far from a being powerhouse.

A half of iPod’s success is ensures by iTunes.com web-store, a third – by iTunes application, while iPod player is nothing more but the concluding link in iTunes.com –iTunes app chain. In its turn, Sony has been trying to vie with the final s component of Apple’s success, without taking into consideration the other ones, which very important indeed. Its own Internet-store is almost unknown due to having less to offer at higher price, on top of that SonicStage application meant for helping users in uploading music to Sony’s players, has become a thing to poke fun of for being a piece of crude software. Besides, these three links of Sony’s are not arranged in a good-looking proposal like that of iPod+iTunes. This failure becomes even more evident when thinking of the corporation as a leading media content creator.

Sony has been making attempts to push on a very own digital music format – Atrac – as a replacement for MP3. Because of that Sony’s players have bound themselves up with a reputation of Atrac-only players, since they were able to play back only this format, all MP3 files were to be converted with loss in quality – in fact, that image has proven to be so deep-rooted that even support for MP3 and them WMA couldn’t help Sony in getting rid of it.

The advertising campaign by Sony is far behind that of Apple as well, as it lacks any mind-taking ideas or recognizable symbols, like those offered by iPod.

Even though the prices set by Sony are not exorbitant, they still seem too high for the company’s current status. Generally speaking, Sony is trying to be “not more expensive than Apple” –the situation the company is currently in, infers that its products should be much cheaper in order to attract consumers.

Having despaired of getting help from Japan, Sony’s Chinese office has decided to push forwards on its own. On the photo – the first Sony’s “Chinese” player witout ATRAC.

All this has made Sony’s players become outsiders even in Japan – most of its “all-new” solutions are cheap, unsophisticated and mainly inferior devices, which aim only at generating a bit more income by exploiting a well-known brand, before the ship goes to the bottom. And regrettably, the situation appears to be beyond help. So, to prevent the “good” (Walkman brand) from becoming a part of history, Sony intensively embeds it in other fields. For example, the sub-brand of music phones, going by the name of Sony Ericsson Walkman has been a success among consumers. Apparently, in future Sony won’t be taking risks of committing Walkman players to “battle” alone and will rather be using them in “squads”, consisting of similar brands and related products. A set of offerings: stationary gaming Sony Play Station 3, portable gaming console Play Station Portable, music-centric phones by Sony Ericsson Walkman and plus Walkman players – should turn out being some kind of ace in competition against Microsoft and Nintendo on the one hand, and Apple – on the other hand. But taking account of now rapidly weakening positions of Sony, outcome even of such massive attack on the market is unclear – in order to make long-term forecasts, it would be better to wait for PS3 release first. But the very fact that Walkman brand today requires support in the form of Sony Ericsson or Play to stay alive distinctly indicates that the company is losing the market, which was once created by Sony itself.

Sony Bean – this model couldn’t stay on Sony’s assembling lines longer than for a couple of months.

iAudio (South Korea)

Cowon-iAudio is the youngest and the weakest player of all global MP3-brands – outside Korea its shares are quite tiny, although the company has managed to find a fitting niche.

Generally speaking, Cowon has acquired a part of iriver’s share, lost by the latter company as a result of unwise actions on the market.

Cowon-iAudio makes most of noise in two fields: unsophisticated Flash-players coming from the medium price-bracket, focusing mostly on sound quality and HDD-powered players. Actually these are the areas, where iriver was formerly in the top of the heap. The company’s debut on the PMP market has also proven to be quite successful.

iAudio X5 – this model is what the Korean company has to thank for its success.

Outside Korea, consumers look for a feature-packed alternative to iPod in the form of iAudio’s solutions. At that Cowon’s products show off quite appealing design and high overall build quality - this has made their reputation go up. The company willingly responds to the community’s requests: there were some cases when iAudio released new firmware versions or even altered the line-up in order to react to consumers’ feedback. For an audience-dependant brand, residing in a certain niche, such policy is the only right thing – as a result iAudio has got one of the most loyal and solid communities out there, which generates enough demand for the company. In many respects, it is how iriver had behaved itself before the company set out to overcome iPod.

Pace of Cowon-iAudio’s development has dropped down along with the whole industry, so that the company cannot afford releasing 2 or 3 solutions a year, yet it looks better than majority of other manufacturers with headquarters in Korea and apart from that, Cowon belongs to that narrow circle of companies capable of maintaining global presence. Similarly to iriver, it owns a number of Internet-stores in Korea; on top of that the company has built itself up a reputation of a software creator, specifically it distributes a quite popular software player Jetaudio.

The appetite comes with eating: after “taking away” Jukebox and Flash MP3-players markets from iriver, Cowon made an attempt to take over necklace-looking players (on the photo - iAudio T2)

Microsoft (USA)

In eyes of an unsophisticated consumer, the company residing in Redmond confronts Apple mainly on the OS market. Nevertheless these two giants are vying with each other for domination over a different field – distribution, purchasing and viewing of digital content. Apple’s AAC and Apple Lossless formats oppose to Windows Media Audio and Windows Media Audio Lossless applied by Microsoft. DRM Fairplay system – to DRM Janus. iTunes software shell competes with Windows Media Player. However the filed of Internet-services and hardware solutions, in other words the industry of portable players, was where Microsoft preferred keeping low profiles and move behind others’ backs till recently. In Internet, its interests were being promoted by a pool of online stores making use of WMA format and DRM-standard. The market of players featured a vast variety of players cooperating with Microsoft by adding support for its formats - iriver, Creative, Toshiba were the most noticeable ones. However these companies had a little success and thus couldn’t popularize their solutions in a proper way, which threatened irreversible loss of the market for Microsoft. By the beginning of 2006 the company started carrying out more intensive policy and got down to establishing a coalition of content providers, manufacturers of both software and hardware solutions. Particularly, with the help of MTV Microsoft created a music service – URGE. It became evident, that release of a Microsoft-branded portable player is only a matter of time. Today the whole world is expecting Zune media player to hit the shelves of retail stores in November.

Guided “leaks” are Microsoft’s latest weapon – a few months before the release, the whole Internet is speculating about new information and boasts “secret” photos of Zune.

The device will be manufactured by Toshiba (Japan) – in fact Zune’s design strongly reminds of the Japanese manufacturer’s own development Gigabeat S, but boasts a bigger 3” display made using low-temperature polysilicon technology, a bundled Wi-Fi adapted and FM-tuner. One of the product’s main advantages for the American market should be its deep integration with Xbox gaming console. In this regard, Microsoft’s strategy is somewhat similar to Sony’s intentions: neither of the companies believes in success of their MP3-players as stand-alone products and thus they are trying to make them a part of some merged “entertainment system”. However information on Zune still has a lot of blank spaces waiting to be filled in – it’s still unclear whether there will be a possibility to purchase content via Wi-Fi without using a PC or not and what integration with Xbox will look like. That is why the possible commercial success of the model is yet obscure; therefore Microsoft can be attributed to the group of global players only in advance without any guarantees being provided

This is the point where we are winding up review of global players and getting a step down – to the local markets.

South-Eastern Asia

Sales of MP3-players in 2005 – more than 14 mln. units

The most crowded market and at the same time the place where overwhelming majority of brands originate from and all manufacturing plants are located at. Basically, examining this market in general is near to impossible – distinctions between local markets are too sharp, therefore we are to turn our eyes to a lower level, as a number of countries over there have got own unique faces.

South Korea

Sales of MP3-players in 2005 – approximately 4 mln. units

Forecast for sales of PMPs in 2006 – approximately 270K units

The homeland of MP3-players and the headquarters for three corporations claiming the title of a truly global brand - Samsung, iriver and iAudio. Not so long ago numerous startups, distributing their products all over the world under various brands, were basing here as well, although today there are not much left – only a quarter of all companies is operating on this market nowadays, as the rest have closed down being unable to withstand the competition and pressure of Chinese manufacturers.

The “golden age” of the Korean players fell on 2001-2004, when the market featured about a hundred of stand-alone manufacturers and several tens of plants. Apart from the “Great trio”, such brands as Mpio, Mobiblu, Sorell, iOps, Cmtech (Live), SIMS, Hansori, Mp-man, Cenix, iBead, Monolith, Qoolqee, Nextway-Dcube had quite good weight on both local and foreign markets. Even though this period is characterized best by natural turnover of players, when some of them were forced to fall back into the shadow, while the others took over their places, but the overall amount of companies remained very high. The drawback of all these manufacturers lied in their line-ups: most of the offerings included only Flash-based players, at that each new generation featured only one model – the older model would get a successor, in a nutshell, positioning was non-existent. But the attractions of Korean devices were major as well – pretty appealing design, high-quality materials, good build quality and furthermore top-notch hardware solutions. It was Korea, where MP3 acquired now standard set of features in the first place: MP3 and WMA support, sound recorder, FM-tunes with a possibility to record broadcasts, line-in recording, conversion into MP3 format, folder navigation, ability to double as a mobile storage device without requiring extra drivers of software for most operating systems.

Back in 2000, when European and American markets had half a dozen brands at best, MP3 players were all the rage in Korea (photo by Writings@Korea)

During 2001-2004, Korean players were having success in South-Eastern Asia, Europe, Middle East, Canada, Latin America, some models even made it to the US market.

However in the year of 2005, many minor Korean companies started being affected by growing pressure coming from two sides at once: in the top price-bracket they could do nothing against Apple mainly due to being weak at marketing, while the Chinese manufacturers, whose prices were many times lower, were about to breach the segments at the bottom of the market. Under conditions of high-risk market, dependant of ever-falling down price for memory, many companies disappeared. Even nowadays Korean manufacturers keep on going bankrupt and retiring from the MP3-market.

For the time being, the market of “pure” MP3-players in Korea is going through the times of deep depression. Two largest players: Samsung and Cowon-iAudio are controlling most of the market, while iriver, after losing its positions, closes the top three, and that’s about it, since the rest of the Korean market is grabbed by several still living startups and Apple. Recently, after missing MP3-revolution from start to end, LG has livened up and even released a couple of attractive products, including MP3-players and portable DMB-players. In fact, only local players with fair sale rates can be self-confident – export-aimed companies are on the verge of bankruptcy. The owner of the largest companies orientating at export sales, Mpio, ended up selling the corporation to a concerned investor; a number of such companies did the same thing. One of the most crucial symptoms of the crisis that has befallen second-rate manufacturers is nearly complete lack of any upcoming models – at its peak, the Korean market saw releases of new models almost weekly, while today all developments are either frozen or shut down.

The place formerly occupied by “pure” MP3-players in Korean got taken by PMP – portable media players capable of playing back both music and video, as a matter of fact the Korean market features many HDD-bases PMPs. A typical device retains a 20-30 Gb storage device, 4,3” color TFT display. The conjecture on the Korean PMP market reminds of now gone “golden age” of MP3 – permanently increasing amount of manufacturers, which are mainly small companies, launching new products almost every week. It’s significant that out of the Great MP3 trio, only Cowon-iAudio has managed to take hold of a share on the new market and maintain it – neither Samsung nor iriver can boast similar success, as possibly fetching models are missing in their proposals.

In its time an “ultimate offering” for the Korean market and major part of the global market was a combination of audio player, sound recorder and radio – today’s Korean PMPs take over the market (the Korean one, for the time being) by incorporating another “combo”: video player amplified by digital TV and satellite navigation. On top of that HDD-PMPs have a vital advantage – their bulky, at least 3.6 inches in size, displays are best for watching video and making use of satellite navigation, which allows them to feel quite protected from being push over by smartphones and handsets. At that, satellite navigation allows invading into another audience – car owners – which remained unreachable for standard MP3-players. So it turns out that this segment is less competitive, but allows for acquiring even more profit – thus it’s not a great surprise that PMP have made MP3-players quit the position of the flagman on the Korean scene. However there is a fly in the ointment as well: localization of such products is not a breeze in light of incompatibility of digital TV standards (Korean DMB is far from being widely spread and thus its future on a global scale is obscure) and hardships concerning adaptation of hardware for satellite navigation in different regions. These are the factors preventing Korean PMPs from getting into the global market at once..

Korean companies offer PMPs which can appeal to even most refined tastes (on the photo – PMP Blufin op67 in Hot Pink)

Apart from HDD-PMP, the Korean companies manufacture high profiles devices for satellite navigation and/or watching digital television – in many ways they are similar to media players with missing HDD, and make use of built-in Flash memory and slots for CF or SD/MMC memory cards. But at that the price for these solutions is significantly lower, which makes them quite popular and allows novices to gain some insight of handiness of such gadgets.

The market of accessories for PMP is also experiencing rapid growth today – car cradles, car chargers, FM-transmitters, external GPS- and DMB-receivers don’t stay too long on shelves.

Image of a today’s Korean PMP:

i-Station V43

- Storage: HDD 1,8" 20/30 Gb

- Display: 4,3" TFT LCD, resolution 480 x 272 pixels, 16,7 mln. colors, touch-sensitive

- Power supply: built-in Li-pol battery, 7 hours of video playback, 10 hours - audio

- Supported video formats: MPEG 1/2, MPEG4, DIVX, XVID, WMV9, subtitles

- Supported audio formats: lossy formats - MP3, WMA, OGG, AC3; lossless formats - FLAC, WAV (PCM)

- Supported image formats: JPEG, BMP, PNG

- Supported text formats: TXT

- Equalizer: 5 pre-installed modes, user-adjustable

- Sound recorder: ADPCM format

- Data transfer interface: USB Device 2.0 High Speed, USB Host 2.0 High Speed

- Data transfer protocol: UMS

- FM-radio

- GPS navigation

- T-DMB receiver

- 5-channel audio-out

- Video-out

China

Sales of MP3-players in 2005 – approximately 6 mln. units

Forecast for sales of MP4-players in 2006 – approximately 1.3 mln. units

China unequivocally displays how cheap an “entrance-ticket” to the MP3 market is. At the moment there are nearly 2000 manufacturers of different size operating on this market, moreover their amount increasing with every passing day. Wholesale price here is at its utmost minimum; owing to this the Chinese companies have already knocked out Korean manufacturers of most of the markets. I suppose you don’t think there are some companies other than Chinese ones in the top three of this market - Newman, DEC, Aigo constitute the leading group and together control more than 37% of the market, while the strongest “outlanders” - Samsung and Apple – occupy only 6% and 4% respectively. The Chinese market seems to be unaware of such words as centralization and consolidation – ten best brands own a bit more than 60% of shares there.

While having an undeniable advantage price-wise, the Chinese products lack a very important aspect – credible design. At the moment there are two types of the “Chinese design” – borrowed and self-developed. The “borrowed” one as a rule is stolen from the Korean neighbors or Apple, sometimes Sony and Panasonic’s solutions are cloned as well. Frequently, such design concepts are “modified”, i.e. gain a color display and different controls, but as a result the wholeness of an image gets ruined.

It’s a real luck to find a brand, which doesn’t have its own “wanna-be’s”, from left to right clones of: iPod, Samsung, Panasonic

Self-developed outlooks are generally boring or too fanciful, at that ease of use leaves much to be desired – 5-6 same-looking buttons with descriptions arranged in row on the back panel are embedded in most products. Cheap plastic, thin, low-grade aluminum, mediocre displays also characterize these devices. China houses production of hardware platforms for players, which are used in majority of solutions, however these chipsets are second-rate, their performance is far below average, and even though the software shells there are more or less stable, interface layout and functionality leave much to be desired. Nevertheless, the price outweighs many drawbacks, but still the way into the high price-brackets is locked for China.

When Chinese designers decide to take everything in their own hands, strange things start happening…

We have already gotten to know the definition of “Korean PMP”, but Chinese manufacturers have a very own concept that, as they claim, soon become the industry’s future – it’s called MP4-player, which is also a PMP but running on Flash memory and measuring a lot less in size. However in China any MP3-players with the tiniest color display sometimes gets tied up with the name of MP4-player. Nevertheless a better example of what this field includes is a model sporting a 1,8” display. While neither digital TV nor satellite navigation is provided on MP4s, the price seems to be the lowest possible. Bundled digital cameras and SD cards with games on them (graphics- and gameplay-wise they are on a par with Nintendo Entertainment System) are all the rage now.

Mess in standards is what prevents similar devices from gaining popularity rapidly both in China and the rest of the world. All MP4-players released to date require video files to be converted into a recognizable format, at that different hardware platforms require different extensions and so happens that today we have up to 10 incompatible video formats. Muddle in technical specifications is another problem, as “USB 2.0” protocols, mentioned by manufacturers, might have 8-times faster/slower speed for different devices.

Actually, the issue is so serious, that even the government has started making moves – Chinese Standardization Committee and a number of involved ministries, are planning on holding a , round-table discussion in the beginning of 2007, where they will discuss and sign documents specifying main parameters of a MP4-player.

Naturally, no laws on standardization can guard MP4-players against competing with video-enabled handsets. On the other hand, price for such phone is going to stay on a star-high level, as compared to Chinese MP4-players (from 50$ for a model with 1 Gb onboard). At that in terms of quality and design Chinese products are rapidly progressing – world-wide acknowledgment of Meizu M6, created in China, is another proof of that.

Image of a today’s Chinese MP4-player:

Meizu M6 (Miniplayer)

- Storage: Flash memory 512Mb/1/2/4Gb

- Display: 2,4" TFT LCD, resolution 320 x 240 pixels, 262K colors

- Power supply: built-in Li-pol battery, 20 hours of lifetime

- Supported audio formats: lossy formats - MP3, WMA, OGG, WAV (ADPCM); lossless formats - FLAC, WAV (PCM); DRM formats: WMA DRM9

- Supported video formats: AVI (XVID)

- Supported image formats: JPEG, BMP

- Equalizer: 10-banded, 5 pre-installed modes, user-adjustable

- FM-radio

- Sound recorder: MP3 format

- Data transfer interface: USB 2.0 High Speed

- Data transfer protocol: UMS

Japan

Sales of MP3-players in 2005 – approximately 6 mln. units

Sales of music-centric handsets in 2005 – approximately 20 mln. units.

Japan was once the trendsetter in the electronics industry in general and the field of portable audio systems in particular. Regrettably, today the Japanese market is taken over by outlanders – more than a half of it hands of Apple iPod, even though the most notable local manufacturers - Sony and Panasonic – have considerable shares of their own, which exceed their shares in other countries, 16% and 8% respectively are not enough to set the pace on the whole market. Further more, problems of both Japanese companies have the same roots – their solutions are unoriginal and hardly appeal to consumers, offer poor functionality coupled with DRM-restrictions and relatively high price. Both design- and functionality-wise they are no match for iPod or “advanced” Korean solutions, on top of that the price don’t let them be on a par with Chinese products. Mediocre popularity of the mentioned brads all over the world originates from the same drawbacks – even in Japan it’s not a rare occasion to see OEM versions of Korean or Chinese devices on retail stores’ shelves.

At the same time, Toshiba keeps a distance away from the mainstream – for quite a while it was trying to push on its own line-up “Gigabeat” powered by hard drive and had quite poor success. Today the company has joined up forces with Microsoft, and launched an own player going by the name of Gigabeat S based off Portable Media Center OS with Windows Media Player 11 as a software shell onboard. That has allowed Toshiba to move up in the rankings, but in the end it still occupies only a certain niche. But its probably most significant role for the company is yet to be played in Microsoft’s latest project - Zune.

Toshiba Gigabeat is getting better with every generation… yet it cannot match iPod (on the photo - Gigabeat S series)

It’s also notable that unlike any other country, Japan boasts incredibly developed cellular networks, especially complementary services – that’s another reason why the volume of MP3-players market here is insignificant and none “national projects” in this field have emerged. Generally speaking, music phones easily do the whole job for MP3-players; as for content, it is purchased mainly via corresponding cellular services (91% of all music content in 2005 was purchased via mobile operators’ services).

Asian “tigers”

So-called “Asian tigers” are to be dwelled on as well – these are mainly Singapore and Taiwan. Markets in these countries are like the Chinese one in some degree, but the local manufacturers rule the roost there - MSI, BenQ in Taiwan, and Creative in Singapore. Even though overall production quality is superior to that in China, OEM versions of Chinese solutions are widely-spread in the abovementioned regions. Another thing of note is that these are Taiwanese companies, namely Foxconn, Asustec, Inventec that manufacture players for Apple on their Chinese factories. Speaking in general, the “tigers” grab attention mostly owing to being located at the intersection of Chinese, Japanese and Korean markets, having long-standing partnerships with Europe, North America and serving as home to a lot of very competitive local companies. As a result we can observe markets with uncoordinated shares, where none of the active brands holds an upper hand: in Taiwan iPod takes up nearly 8%, while Samsung is close on the heels of Apple with its 7,8%.

Europe

Sales of MP3-players in 2005 (without the UK) – approximately 22 mln. units

On the whole, Europe doesn’t have any local manufacturers of MP3-players, saving for Philips, nevertheless it has the players produced (maybe designed as well) by a Taiwanese company. Another exception is Archos, that has transformed from a French company into joint venture with offices both in the US and France.

However Europe market in practice turns out to be perhaps the world’s largest market. The patterns on the markets of continental Europe and the UK significantly differ – while the Great Britain is an iPod’s domain, the continent seemingly prefers re-branded Chinese players.

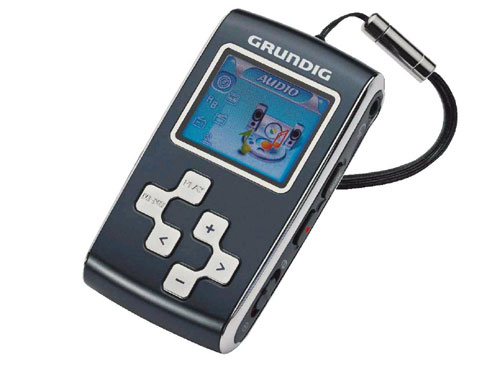

Each of the main markets – Germany, France and Scandinavia – has its own set of intensively promoted trademarks - Maxfield and Trekstor for Germany, ISM for France Jens of Sweden for Sweden. “Zombie-brads” (trademarks of companies long dead that were bought and filled up with new contents) haven’t lost their popularity either - Grundig, Mpman are among these. Actually, by buying these products you get relatively cheap (for Europe) players made in Chinese or less frequently, in Korea. All in all Europeans give more preference to low-priced solutions – poor design and mediocre functionality of “Chinese” cannot prevent them from purchasing it. The most unsophisticated Flash MP3-players have the highest popularity ratings.

Known brands cannot afford just laying down and dying at once – “second wind” of Grundig brand wraps a Korean Oracom UB-880

In many respects that is how Creative manages to achieve acceptable sale rates, particularly of Muvo-labeled Flash-based players. On the whole continental Europe generates most of the sales for the Singaporean company.

In pursuit of higher income, European players usually resort to original moves – lately the market has seen numerous releases of MP3-players designed to fit some band’s image. Such actions aim at making users change players more often or even user a couple at once – that is motivated with permanently dropping prices as well.

Special edition of TrekStor i.Beat vision for Depeche Mode fans has mastered the art of camouflage – only an experienced user will realize that it’s only a Korean Dyne Tuny 7

Longstanding contacts with Asian manufacturers, considerable volumes of orders, and undeniable experience of sale techniques result in a situation when brand start dictating own will by demanding exclusive models and limited editions from suppliers. Maybe the most striking example of such policy is mode Trekstor vibez. Having accumulated enough resources and gathered experience, local European trade marks seriously consider the ways of getting into the global market. And it’s not improbable that they will actually succeed in that – such companies have already displayed more common sense in their decisions than most of the market’s grandees.

Image of a today’s European MP3-player:

Trekstor vibez

- Storage device: HDD 1" 8/15 Gb

- Display: 1,5" TFT LCD, resolution 176 x 132 pixels, 65K colors

- Power supply: built-in Li-ion battery, 20 hours of lifetime

- Supported audio formats: lossy formats - MP3, WMA, OGG, WAV (ADPCM); lossless formats – FLAC; DRM formats - WMA DRM9, 10

- Supported image formats: JPEG

- Equalizer: 5 pre-installed modes, 3 modes available for manual setup

- Sound recorder: WAV ADPCM format

- Recording from line-in: WAV ADPCM format

- Data transfer interface: USB 2.0 High Speed

- Data transfer protocol: UMS, MTP

- Accessories: wired remote control, cradle with a wireless remote control, extension card – FM-tuner, extra Li-ion battery

USA

Sales of MP3-players in 2005 (without the UK) – more than 20 mln. units

iPod share – not less than 15 mln. units

The US pretends to being the world’s largest market. Also, it’s in a small group of mono-branded markets, where a single company controls nearly 75% of the market, which is a stunning share when comparing it to the Asian countries. Actually, there has already been said much about Apple’s groundbreaking success – what is really important, is the fact that iPod in the US, and in the whole world (to some extent) represent the whole industry and therefore Apple’s further steps will shape the future of MP3-players as products in many respects, at least on the American market. At present the company is hesitating to announce its new offerings, which have been highly anticipated for more than a year. And naturally this affects the sales in a very negative way – consumers just don’t want to buy “old” iPod G5 or iPod Nano. What products will be introduced this Christmas is one of the market’s greatest mysteries to date, however there are some clues enabling us to suggest two versions – a “true” iPod Video or a handset iPhone. While the internet is oozing various rumors and speculating about that, we will try to look deeper and find out the influence that might be exerted on the market with the release of either of these products.

Launch of iPhone will inevitably lead to “Japanization” of the American market, in other words, domination of Music Phones. However this way holds a lot of hardships for Apple. First, it’s unclear how iPhone would handle being a handset – Apple might turn to an already existing mobile operator or establish a virtual one of its own, but the ways of adapting such phone for foreign markets are somewhat obscure. Second, whether Apple would be able to meet the market’s demand or not – even relatively small supplies of iPod had certain issues concerning quality, and what is going to happen should there be tens of millions of devices? Furthermore, we should remind you that Apple doesn’t have own manufacturing plants. The case when consumers would be simply disappointed with the product is not to be ignored either – they are waiting for something truly incredible, and frequently even can’t explain it, as it’s something beyond words. Not to let its fans down in the very first step on the market that has been developing for ten years without the company’s presence – a really hard task even for Apple itself.

Should Apple give preference to the “true” iPod Video, the US market might adopt certain traits of the Korean market – the device would definitely boast digital TV capabilities and satellite navigation, at least its accessories would. However, even in this case the company would be running risks of losing shares on the “mass” MP3 market and driving into a minor niche.

Certainly, nothing stands in the way of developing of both ideas – iPod G5 into iPod Video, and iPod Nano – into iPhone.

There are a few things on the Web that can generate more hype than new products by Apple. One of the countless fancies on iPod Video that have been flooding the Net for more than a year now.

Whichever path Apple decides to step onto, one thing is for sure – the US market will be affected. In its homeland, the company plays the role not of an all-time leader – it has also forged the way consumers behave themselves in. Owing to Apple’s efforts, the US market favors so-called Jukeboxes – MP3-players with embedded hard drives (capacious of 20 Gb and more). This is the most different thing from Asia and Europe, that appreciate Flash-players instead (even 256 Mb and 512 Mb ones are still in demand). That market pattern in some ways parodies the car market, where off-road cars and wagons are popular mainly in the US, whereas Europe and Asia are domains of midget cars. With the advent of Shuffle and Nano, the overall situation hasn’t changed much – these players are rather presents for children and wives, similarly to a small Japanese car standing in a garage with a SUV. On their capacious iPods (with many Gbs onboard) Americans store all their collections of music, as a rule, purchased via iTunes. Many of them don’t even bother copying collections to PCs, so that should such player be stolen, it turn out to be a double tragedy – gigabytes of music (1 dollar for a track) get lost as well.

But enough talking about Apple, as the market features other noticeable players - Sandisk and Creative - however their shares, even if summed up, won’t make even 15%. Particularly, for Creative, which spent vast sums of money on advertising in the US, 5% share (or even less) on the market is a shattering defeat.

On the other hand, Sandisk is riding high, since a year ago it’s presence on the market was near to nothing, and nowadays it shows off 10%. A large-scale Flash-memory manufacturer and Flash-based products (mainly memory cards) has been forging into the lead, on the part of the US market left or forgotten by Apple, over the last six months. The company’s formula is quite simple – it adopts leader’s latest solutions, boosts them with demanded features, like memory expansion slot, radio and sound recorder; fairly competitive pricing policy and ability to offer the biggest storages are the factors of not the least importance. Today Sandisk’s flagship - Sansa e200 equipped with 8 Gb of Flash-memory and microSD slot costs 250$ in the US, the same sum of money will by a iPod Nano with 4 Gb onboard. Such strategy usually has to push pressure upon the market’s leader and force him to somehow react to an ambitious newcomer’s actions. Knowing all this, Sandisk is provoking Apple deliberately – a striking instance of that is company’s “hidden” advertising campaign iDon’t, which agitated Americans on the streets and on the web against being just like everyone else, in other words – against buying iPod. Sansa e200, according to this campaign, was the thing to purchase instead. In fact, these steps by Sandisk copy the leader’s solutions in many ways – accessories with “Made for Sansa” label look quite unoriginal as against “Made for iPod” applied by Apple. At the same time we cannot say all this poses a serious threat to Apple’s shares – in some respects, such competition act in its favor, as consumers get an illusion of choice, while presence of more or less strong rivals lets Apple avoid confrontations with antimonopoly committee and on top of that motivates further development. For the time being all Sandisk’s efforts are aimed at taking over the US market – in other regions the company’s shares are very tiny. One even might say that Sandisk adopted Rio’s share, now-dead on the US market.

Sandisk is looking to overcome iPod itself (photo by www.lilmonsta.com)

A minor, but yet noteworthy segment includes devices dealing with digital satellite radio broadcasting – this market is ever-growing market has already reached the level of 10 mln. subscribers in the USA. Such gadgets, while being manufactured by Pioneer and Samsung for example, appear in retail stores under different brands, like XM or Sirius On top of handling digital and Internet radio, these devices have bundled memory for storing content, as a rule Flash modules with up to 2 Gb onboard, and color displays. By the way, the possibility to record digital broadcasts has provoked RIAA to initiate a court examination, the outcome of which is yet to be emerge.

Image of a today’s American MP3-player (non iPod-branded):

SanDisk Sansa e200

- Storage: memory 2/4/6/8 Gb

- Display: 1,8" TFT LCD, resolution 220 x 176 pixels, 65K colors

- Power supply: built-in Li-ion battery, 20 hours of lifetime

- Supported audio formats: lossy formats - MP3, WMA, WAV (ADPCM); DRM formats - WMA DRM9,10

- Supported video formats: closed format, processed via software

- Supported image formats: closed format, processed via software

- Equalizer: 7 pre-installed modes, user-adjustable

- Sound recorder: WAV ADPCM format

- Recording from line-in: WAV ADPCM format

- Data transfer interface: USB 2.0 High Speed

- Data transfer protocol: UMS, MTP

- Micro SD slot

- FM-tuner

Russia

Sales of MP3-players in 2005 (without CD-MP3) – more than 1 mln. units

The Russian market appears to be quite unpretentious as compared to the world’s largest local markets, but yet it possesses a number of peculiarities, enabling us to attribute Russia to the group of Eastern European markets.

Particularly, these markets, unlike those of the Western Europe, tend to be less dependant on price and agree to pay more for design, quality and functionality – this is what has determined strong positions of Korean manufacturers and quite tiny shares of Chinese players here.

Resemblance to the Western Europe lies in presence of numerous local brands that distribute Asian MP3-players under own logos according to OEM-agreements – these private-labels take up less than 50% share, while the major companies: Samsung, iriver and Apple, and to a certain extent Cowon-iAudio – control not more than 40% altogether. Lately the «forage reserve» of the companies owning private-labels, in other words, amount of small Korean manufacturers offering OEM contracts, has been dramatically decreasing – this has forced the Europeans to occasionally confront each other for vendors, which allows the latter to make terms of their own. Although several players have already started adding more affordable Chinese products to their proposal pools.

Along with classic MP3-players, media-players, enabling users to watch video and read books (what is important for the Russian market in particular), are gaining the momentum behind them.

What really makes Russia stand out against other markets, is enormous and, more importantly, stable demand for CD-MP3 players, which have been either long forgotten by now or unknown to the rest of the world. It’s needless to explain why they create such phenomenon on the market.

The Russian market is prone to iPod-mania more than the European one – this fact originates from lack of investments into promotion of MP3-players or brands themselves by other companies over the past 7 years. This trend reveals itself especially when examining the Western Europe, where these devices are hyped by means of both outdoor and TV advertisement, as well as loads of periodicals devoted to MP3-players alone. Such informational vacuum, though, got filled up with much articles, mainly translated ones, on iPod, which have eventually made up consumers’ minds, so that some think of Apple’s player as the most superior solutions available. Basically, the employees of Apple shouldn’t be given a credit for building up that image, as the company’s marketing efforts are fading away and information on iPods frequently gets to the country in a spontaneous way, however that has proven to be just enough for a market with mainly passive players.

The only exception, that deserves a note, is Samsung, whose intentions to take over the Russian market are becoming more and more evident, as it starts making use of outdoor and TV advertisement, spreads into Internet. Samsung’s policy for Russia in terms of MP3 players seems to be somewhat similar to that applied for handsets here – at least marketing moves are identical: the E900 (handset) got tied up with “Phantom” name for the Russian market, while the YP-Z5 (player) is known here as Z-Metal. Combined with a wide line-up and fairly high-quality products, this allows the company to secure a significant share on the market.

After crossing the Russian frontier, Samsung YP-Z5 mysteriously transforms into Z-Metal

Russia might be the only country with a lot of consumers loyal to iriver brand – facts are facts, the company has high sales generated here. But this popularity has more of sluggishness in it, as in the past it managed build up a name owing to splendid CD-MP3 players, which have been demanded on the Russian market more than anywhere else; the company’s first Flash and HDD players were also very advanced on their release dates. For the time being iriver keeps on coming up with mainly second-rate solutions and on top of that making many mistakes in the line-up forming. Nevertheless its products are considered to be really credible devices by many.

IMP900 –one of CD-MP3 players, which have built up a name for iriver in Russia

On the whole, after giving a close-up to the global market, we can draw a conclusion that it hasn’t got even the slightest hint of unity or general fundamentals. The market itself is tremendously segmented, core companies, which would set the pace and guide further development of the industry are non-existent – as a matter of fact, the entire field is in the hands of numerous minor companies, pushing forwards using cut and try method. Long-ago pioneers: Creative, iriver, Apple – cannot give the market any innovations or cutting edge technologies anymore and rather prefer borrowing proven solutions and relying on design and marketing. All this has resulted in lack of a core concept in the industry, when even the largest corporations cannot make long-term forecasts or speak about possible ways of the market’s development with due confidence.

Alexey Doroghin (adoro@list.ru)

Translated by Oleg Kononosov (oleg.kononosov@mobile-review.com)

Published - 20 September 2006

Have something to add?! Write us... eldar@mobile-review.com

|

News:

[ 31-07 16:21 ]Sir Jony Ive: Apple Isn't In It For The Money

[ 31-07 13:34 ]Video: Nokia Designer Interviews

[ 31-07 13:10 ]RIM To Layoff 3,000 More Employees

[ 30-07 20:59 ]Video: iPhone 5 Housing Shown Off

[ 30-07 19:12 ]Android Fortunes Decline In U.S.

[ 25-07 16:18 ]Why Apple Is Suing Samsung?

[ 25-07 15:53 ]A Few Choice Quotes About Apple ... By Samsung

[ 23-07 20:25 ]Russian iOS Hacker Calls It A Day

[ 23-07 17:40 ]Video: It's Still Not Out, But Galaxy Note 10.1 Gets An Ad

[ 19-07 19:10 ]Another Loss For Nokia: $1 Billion Down In Q2

[ 19-07 17:22 ]British Judge Orders Apple To Run Ads Saying Samsung Did Not Copy Them

[ 19-07 16:57 ]iPhone 5 To Feature Nano-SIM Cards

[ 18-07 14:20 ]What The iPad Could Have Looked Like ...

[ 18-07 13:25 ]App Store Hack Is Still Going Strong Despite Apple's Best Efforts

[ 13-07 12:34 ]Infographic: The (Hypothetical) Sale Of RIM

[ 13-07 11:10 ]Video: iPhone Hacker Makes In-App Purchases Free

[ 12-07 19:50 ]iPhone 5 Images Leak Again

[ 12-07 17:51 ]Android Takes 50%+ Of U.S. And Europe

[ 11-07 16:02 ]Apple Involved In 60% Of Patent Suits

[ 11-07 13:14 ]Video: Kindle Fire Gets A Jelly Bean

Subscribe

|