Spillikins #103. Annual reports and the downfall of Symbian together with Nokia

Last week all manufacturers released data of their annual performance. Those who did it earlier have been already mentioned in the Spillikins, but now we can give the entire market a closer look and analyze figures of Nokia, which is still a market leader. The fans of the Finnish company must be unhappy. Due to the abundance of events we will have unprecedented two issues of the Spillikins this week. You cannot squeeze everything into one review. First read about companies performance results with the rest of events to follow in the next material.

Contents:

- 2010: ZTE moves forward

- Accounting tricks of Nokia

- Motorola looks up into the future

- HTC beats new records

- LG must change the strategy

2010: ZTE moves forward

Results of 2010 according to IDC impress by the fact that for the first time in history a Chinese company has broken into the top 5 and now occupies the forth position in the world. Successes of particular manufacturers will be analyzed later on. Let's start with the overall market indicators.

| Top Five Mobile Phone Vendors, Shipments, and Market Share, 2010 (Units in Millions) |

| Vendor |

2010 Unit Shipments |

2010 Market Share |

2009 Unit Shipments |

2009 Market Share |

Year-over-year Change |

| Nokia |

453.0 |

32.6% |

431.8 |

36.9% |

4.9% |

| Samsung |

280.2 |

20.2% |

227.2 |

19.4% |

23.3% |

| LG Electronics |

116.7 |

8.4% |

117.9 |

10.1% |

-1.0% |

| ZTE |

51.8 |

3.7% |

26.7 |

2.3% |

94.0% |

| Apple |

47.5 |

3.4% |

25.1 |

2.1% |

89.2% |

| Others |

439.4 |

31.6% |

342.9 |

29.3% |

28.1% |

| Total |

1388.6 |

100.0% |

1171.6 |

100.0% |

18.5% |

Source: IDC Worldwide Mobile Phone Tracker, January 27, 2010

Note: Vendor shipments are branded shipments and exclude OEM sales for all vendors. |

The market leader (Nokia) keeps on losing its market share. In 2010 they lost a staggering 4.3%, which was achieved in the second part of the year. Not a single company has ever collapsed so quickly. Look at sales figures for the fourth quarter of 2010 (IDC). Nokia failed to sell the same amount of handsets as a year before. The decline of a quarterly share on an annual basis is even more frightening. The company is in big trouble and the words of its CEO that in the first three months of 2011 there will be no signs of recovery mean that Nokia can surrender even more in the face of competition at the start of this year.

| Vendor |

4Q10 Unit Shipments |

4Q10 Market Share |

4Q09 Unit Shipments |

4Q09 Market Share |

Year-over-year Change |

| Nokia |

123.7 |

30.8% |

126.8 |

37.2% |

-2.4% |

| Samsung |

80.7 |

20.1% |

68.8 |

20.2% |

17.3% |

| LG Electronics |

30.6 |

7.6% |

33.9 |

10.0% |

-9.7% |

| ZTE |

16.8 |

4.2% |

9.5 |

2.8% |

76.8% |

| Apple |

16.2 |

4.0% |

8.7 |

2.6% |

86.2% |

| Others |

133.4 |

33.2% |

92.8 |

27.3% |

43.8% |

| Total |

401.4 |

100.0% |

340.5 |

100.0% |

17.9% |

Source: IDC Worldwide Mobile Phone Tracker, January 27, 2010

Note: Vendor shipments are branded shipments and exclude OEM sales for all vendors. |

Samsung increases its share gradually. In 2010 they gained only 0.8%, but the company is growing. The gap with Nokia in front is now only 12.4%, while a year ago it was 17.5%. It clearly illustrates, which manufacturer has a winning formula.

LG was the only company to record the loss of its market share coupled with the decline in sales. The reason for this phenomenon is dumping strategies of LG and inability to ship enough models at attractive prices. On the other hand, Chinese companies rivaled LG in the segment of inexpensive solutions.

Apple keeps on boosting its sales, but the key issue is the fact that Apple earns more on its handsets than any other manufacturer. Boasting only 3.4% of the market Apple is the leading company in terms of profit margins, which is fantastic.

Back to the table of contents >>>

Accounting tricks of Nokia

Nokia is going down and its team has problems steadying the ship. Results of the final quarter and 2010 in general show the impotence of management and all previous mistakes came to the fore. There are so many issues associated with Nokia that we will have several sections here.

Smartphones market: a loss of 30%

Smartphones are the main section for the development of any manufacturer now. Customers need such products and make their opinions heard. Any company has to offer successful models in the segment first. Nokia is the only exception.

In the first part of 2010 Nokia was growing as fast as the market in general, which helped not to lose its share quickly. In the second half of 2010 the situation suddenly deteriorated. At the beginning of 2010 Nokia accounted for 39% of the smartphone market. The figure remained the same for the first quarter of 2010. In the second quarter they had almost 39%, but in the third quarter Nokia slipped to 33% with a 28% share in the final quarter of the year. In 2010 Nokia lost 30% of the smartphone market with the absolute loss of 11%.

Nokia sees problems quite well and tries to improve the showing in any way they can. The company exaggerates its share of the smartphones market. For example, Touch&Type series belongs to smartphones according to Nokia, though it is build on S40. In other words Nokia views all touchscreen models it sells as smartphones. Do you need any confirmation? Nokia mentions the sales of "converged devices", which is always backed up by data from IDC. This is what they write in the annual report:

"Nokia overall unit volume slipped 2.4% in the fourth quarter, which the vendor attributed to the "intense competitive" environment and component shortages. The result was lower feature phone shipments. The company did, however, grow smartphone volume by 38% compared to the same prior-year quarter. Nokia launched the C7 and the C6-01 touchscreen smartphones as well as the C3 combination touchscreen & QWERTY device in the fourth quarter. Still, smartphone ASPs dropped 16% on a year-over-year basis."

The key sentence here is "Nokia launched the C7 and the C6-01 touchscreen smartphones as well as the C3 combination touchscreen & QWERTY device in the fourth quarter". Luckily, IDC is not independent in its classification of handsets and gets data from manufacturers thus following their approach. It is only a small drop of water in the ocean of its annual report, but it highlights how companies strive to improve their results by any means.

IDC claims that the overall sales of smartphones grew by 38% in comparison with 2009, but the average price of a Nokia smartphone went down by 16%. What does it mean?

We have been discussing these issues at Mobile-Review.com throughout the year. Nokia buys its market share by offering inexpensive handsets on S60, which are considered by consumers as cheap touchscreen models from Nokia. They view them as ordinary phones only, though Symbian inside and overall features make them smartphones. Remember the survey of Nokia smartphone owners in UK. The majority will not recommend such handsets to their friends, because owners are shy of their Nokia smartphones. Do you need any explanations of popularity for other platforms and the drop in the average price of a Nokia smartphone? The company can now attract customers only by the low price of its smartphones.

We know what this approach leads to. Look at Siemens, Panasonic, and Motorola, which lost its second place in the market, but at least managed to survive. Unfortunately, Nokia has no aces to use here. Why?

In 2010 Nokia failed to deliver on all of its promises. After losing the battle in 2009 the company promised to change the game with Symbian^3 and new devices based on this OS. Did it happen?

In the final quarter of 2010 Nokia N8 became the first model on Symbian^3 to hit the shelves. September of 2010 saw the beginning of heavy promotion worldwide. N8 remains the flagship even at the start of 2011. 65% of the entire advertising budget was used for the model. Advertising expenses of Nokia remained the same in 2010, so the whole company promoted one model only and they did it desperately. While discussing quarterly results with analysts the CEO of Nokia Stephen Elop said that in the final quarter of 2010 Nokia sold 5 million Symbian^3 devices.

This group was represented by Nokia N8, C7, and C6-01. N8 was the first to be launched. Its sales had to be the highest, but the same could be said about the price. Cheaper products always sell better if they have similar features. The abovementioned models have many things in common. С6-01 performed better event though it appeared later in the year. In Russia С6-01 outperformed N8 by 3 to 1 (in the case of Nokia we mean shipments to partners and not retails sales, but we need to understand the overall performance of models). Nokia C7 sells in similar numbers as N8. Rough estimates show that Nokia N8 is not extremely popular and the price is also a factor here. Consumers are not crazy about Nokia models and even the lower price of N8 in comparison with previous flagships of the company could not help.

Frankly speaking, 5 million Symbian^3 smartphones boosted the average price of a Nokia smartphone from €136 to €156 during the final quarter. It is a good result if you ignore the average price of a Samsung smartphone, which reached €189 in the fourth quarter of 2010 courtesy of Galaxy S (Samsung sells fewer smartphones and is a profit oriented manufacturer in this segment).

Unfortunately, Symbian^3 could not boost the position of Nokia. The company promised to boost its competitiveness every quarter, but the promises were never supported by real actions. Remember a 6 month delay of Nokia N8, while Nokia E7 was postponed from December of 2010 to February-March of 2011. Moreover, Stephen Elop says the model will not influence overall sales until the second quarter of 2011. Nokia will be able to sell the required number of E7 only in the second quarter of the year, which is a total failure.

The same sad story is associated with the last Nokia smartphone hope in the shape of MeeGo. N9 was ready in the summer of 2010, but the software was not developed yet. The hardware became outdated during the last 6 months and Nokia will have to start from scratch and create a new model with the same name. I am afraid that hopes around MeeGo are overestimated and these dreams may never come true, especially taking into account that the project is headed by people who ruined Symbian.

We need another ecosystem

Do you think Nokia is ignorant of the situation around Symbian? Stephen Elop has the following to say: "Nokia must compete on ecosystem to ecosystem basis. In addition to great device experiences we must build, catalyze or join a competitive ecosystem. And the ecosystem approach we select must be comprehensive and cover a wide range of utilities and services that customers expect today and anticipate in the future."

In other words Nokia openly admits that its strategy does not work. Can you interpret this quotation otherwise? These three sentences led to a whirlwind of gossip. Once again we heard that Nokia is planning to join Android. I think it is not true. If it follows this road Nokia will disappear if not immediately, but in 10 years time. The situation is not that bad. Being a market leader Nokia has resources to make a U-turn and change the situation.

To my mind Stephen Elop means a system not the devices. He believes that Nokia makes excellent products, but has problems with the ecosystem (OVI does not perform well and inflated data for OVI Store are well known to the management). What was going on inside Nokia during the last quarters? It ditched almost all OVI services (OVI Share, OVI Files, OVI Mail; OVI Chat was transferred to Yahoo, while OVI Music Unlimited was shut down for the majority of markets). They only have OVI Store, which clearly loses to competition. There are not enough of apps for S40/S60 and the quality suffers as well. Nokia is a complete outsider here.

How can you create an ecosystem? Nokia tried to do it, but OVI failed. I don't think the company will run the risks to try again and commit too much money, time and resources for a similar project. What can they do?

Nokia can join others, which is an extremely important decision. The company cooperates with Intel in MeeGо, but Intel has no ecosystem. They just sell hardware to Nokia and adjust the OS for laptops. Microsoft has already come up with Windows Phone 7 and plans to boost its mobile presence by developing desktop software for ARM processors. In future Windows Phone 7 handsets we will see desktop OS redesigned for lower screen resolution and touchscreen controls. Microsoft doesn't hide their plans and promises to make MS Office available for ARM processors in 2012. Can Microsoft offer an ecosystem? Surely, they can! Is it mobile today? Not yet, but it will become in future.

Nokia can capitalize on strategic partnership with Microsoft, which had started before the arrival of Stephen Elop, who came from this company. There are no conflicts of interests. Microsoft wants to sell its main products (MS Office and similar suites), while the future of Windows Phone 7 and its incarnations is not clear. Microsoft can use several approaches and the cooperation with Nokia looks attractive. By any means we should not think that the words of Stephen Elop mean plans to use other OS for Nokia phones (Windows Phone 7 project can be used for the US market and will not work internationally). So far Nokia will follow the old strategy and there will be now tectonic changes.

Back to the table of contents >>>

Motorola looks up into the future

In 2010 the company retreated from the majority of markets and concentrated on its US sales. This approach allows saving resources, but at the same time it reduces sales. The key question is can Motorola create a competitive lineup of Android models and return to the markets it deserted. This can happen no sooner than in 2012 if the most optimistic scenario works. In Europe Motorola products are still available in UK, France, Germany and to some extent in Spain. This presence is not prominent and nothing will change in 2012. Outside the US Motorola will target Latin America and China.

At the moment the company is still trying to survive and CEO Sanjay Jha partially confirmed that US forecasts for 2010 were slightly off the mark. Motorola emphasized its flagship solutions like Motorola DROID and mid-price offerings, for example CLIQ. US consumers preferred expensive models, while the demand for moderately priced phones was limited.

Due to this and other reasons Motorola will limit the support of mid-priced phones. According to the company, the update of the OS is not that important in this price segment. Motorola follows the road tried before by Samsung and Sony Ericsson. In fact mid-priced models and inexpensive Android smartphones will not get an official OS updates. Businesswise this solution is sound, but consumers will be unhappy.

At the end of February Motorola will begin the sales of its first tablet - Xoom, and during the year they plan to offer several models in different form factors and with the screens ranging from 7″ to 11″. Motorola also believes that tablets are ideal for home TV and will provide appropriate products. CEO Motorola was talking about the future as Motorola Mobility was founded only this January. After Motorola splitting into two parts the phone division will start from scratch. Almost.

Back to the table of contents >>>

HTC beats new records

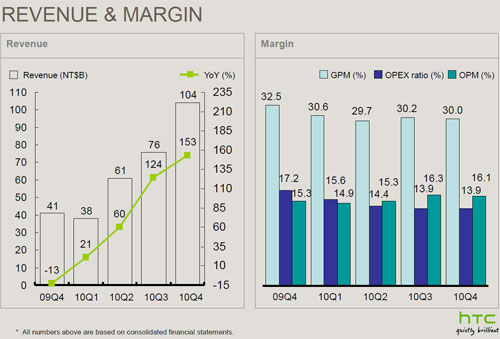

HTC produces only smartphones, while Smart is the only exception. At the same time it did not influence the sales of HTC products. In 2010 HTC broke many records due to the popularity of Android. HTC could offer HTC Sense, which is a serious advantage many customers are ready to pay for.

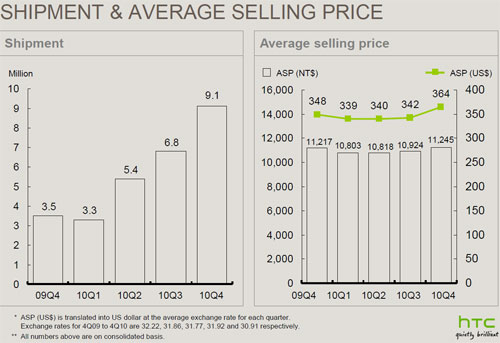

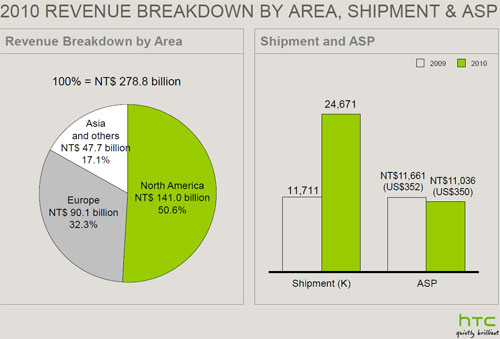

Sales growth reached 111% in 2010 and HTC managed to sell 24.6 million handsets in comparison with 11.7 million a year earlier.

North America is the target market for the Taiwanese manufacturer and it gives 50% of sales, while 30% come from Europe. The average price of an HTC smartphone has not changed much and stayed at the record-breaking $350 (compare with €156 for Nokia in the 4th quarter of 2010).

In 2011 HTC plans to triple its sales and ship as many as 60 million handsets. The same amount is planned by Samsung. It is interesting to see how the sales of Android smartphones motivate manufacturers and provide them with some kind of bonanza. HTC is a prime example as Windows Phone 7 sales are not important here and Android delivers the bulk of the growth.

Back to the table of contents >>>

LG must change the strategy

There is no place for miracles in the business world and LG started losing its market share. In 2010 the company delivered cheapest Android smartphones and took the market by storm with its Optimus range. The prices were 25-30% lower than those offered by competitors and gave good sales together with market share growth in several segments. At the same time LG sacrificed its margin. The results of the policy became obvious at the end of the year when in the final quarter LG lost $232 million. What to do next?

The answer is simple. Around two months ago LG launched an extensive restructuring program and introduced a new pricing policy. The dumping will no longer be used for some models, so the prices will go up. The market share will shrink, but losses will be cut. In the next issue of Spillikins you will read about the price of Optimus 2x, which is being decided at the moment. You may be unpleasantly surprised.

Do you want to talk about this? Please, go to our Forum and let your opinion to be known to the author and everybody else.

Back to the table of contents >>>

Related links

Eldar Murtazin (eldar@mobile-review.com)

Twitter Twitter  Livejournal Livejournal

Translated by Maxim Antonenko (maxantonenko@ukr.net)

Published — 01 February 2011

Have something to add?! Write us... eldar@mobile-review.com

|