Russian market of terminals in the 4Q 2003. Results of

2003.

Press release, January 19-th 2004

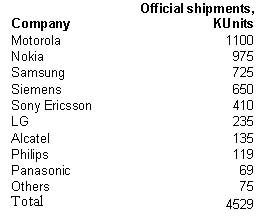

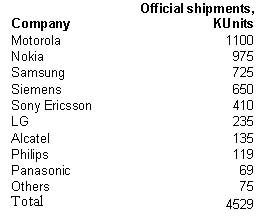

Statistics: Official sales of terminals

on the Russian market suggest 4 053 000 units in the 4Q while

in the third quarter the sales volume was 4 529 thousands.

Sales fell by 11.5 % and the main reason

for that - shortage of the equipment. Volume of the grey market

was 4.5%. It is the lowest for the last several

years. Total market volume in 2003 was 15 million

117 thousand of mobile terminals (these figures include

grey market).

Short description of the market situation.

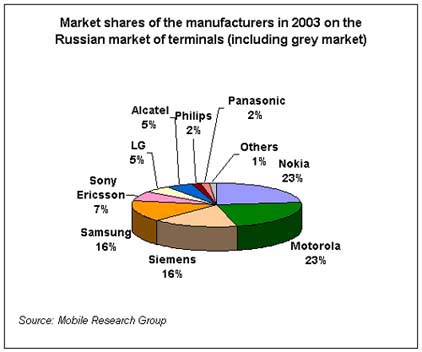

For better understanding of the market situation let us return

back to the data of the 3Q. The market shares of the third

quarter are as displayed below.

Shipments of mobile terminals into Russia from mobile phone

companies are as follows. We’ve decided to provide you

with the wholesale deliveries from the manufacturers (sell-in),

instead of the retail sales:

The amount of the shipments comparing to the first six

months has grown for all manufacturers. Some of them even

faced the lack of capacity; they had been unable to satisfy

the demand on Russian market. We’d like to remind you

that European market is the top priority for most manufacturers,

except for LG who are specializing on Russian market. Third

quarter’s sales were so high that the storages were

almost emptied. And now we can see a deficiency of mobile

phones in stores.

One of the reasons of deficiency is amazingly high demand

on mobile phones around in Europe, another one is underrated

predictions for Russian market made by the manufacturers.

The predictions were rather pessimistic; the sociologists

didn’t notice the growing market with high demands.

In conditions of low demand for phones in Europe the given

strategy is justified. But it stops working as soon as the

phone become highly demanded at all markets, representations

of the manufacturers are struggling to get a bigger quote

for their region. This is what had happened at the Russian

market.

Sony Ericsson can probably be recalled as a typical example.

The shipments to Russia decreased 5.5 times, from 410 thousands

to 75. The most popular model, T610 had really small number

of shipments meanwhile slightly popular T100 had large amount

of copies being sent to Russia.

The increased demand affected Siemens as well. The decrease

of the shipments was not so significant, however it was noticeable.

The company’s representatives marked out several times

that the demand is significantly exceeding the current offer.

This situation was occurring with almost all companies that

are represented in the Russian market. The only difference

was that one of them had the handsets, and the others didn’t.

Samsung, for example, couldn’t handle the demand for

its C100 when it was released. This lead to short rise of

retail prices for this model, since the distributors were

trying to correct the lack of handsets by their price.

Increase of sales for the second players can be used as

an indirect confirmation for this situation. When there is

no headsets from the “big four” of the manufacturers

– the small ones have occupied their niche. Their shipments

were at the highest level, and the sales went great for almost

all models in the budget and middle price segments.

When we are saying that all manufacturers were experiencing

the lack of available handsets, we’d had to exclude

Nokia. They weren’t having such problems; each distributor

was able to purchase as much handsets as he needed. The only

model that had sort of deficiency was budget model Nokia 3310,

which still remains Nokia’s most popular model on the

Russian market.

An average price for a Nokia phone is about 153 dollars

(wholesale prices for all line-up of handsets). Samsung is

the only company that has even higher average price. However

apart from other manufacturers we can see that Nokia has slower

realization of their products in the retail networks (4-5

weeks vs 3-4 in the usual case), this negatively affects on

wholesale shipments to Russia. The company put a lot of effort

during Q4 in order to fix this problem; they’ve started

working on providing the distributor status for several companies

at once. You want to know the companies names? Well, it wasn’t

hard to guess, if you are analyzing Nokia’s activity.

For example in Moscow they’ve tried to take Siemens

place in Alt-Telecom’s shop network. This negotiation

took place in Q4.

Similar situation occurred with “Svyaznoy”

shop network, who are Siemens biggest partner. Siemens sales

share in Svyaznoy decreased from 36 to 20 percent during last

year. Maxus (owners of Svyaznoy) commercial director Denis

Lyudkovsky mentioned this in an interview to Russian local

newspaper. The fact that Nokia’s products partly replace

Siemens from now on looks logical.

The third factor is company’s Anarion position, who

have made an agreement with Nokia in Q4. This company may

soon become the official distributor for Nokia’s products,

if they decide this action to be worthwhile.

Nokia really needs attracting big retailers to their products

realization. This is the only market in Russia where expensive

models are in demand.

Without looking at Nokia’s efforts, commodity stocks

in warehouses of distributors have grown, and its total number

became incredibly high on the 1st of January – about

320 thousands of terminals. About 80% of them are expensive

models that cost more than 150 dollars. Something tells me

that Nokia will try to get rid of these phones during 1Q of

2004. Seems that Nokia will use the good old big price cut

tactics for one or two models; that are the most attractive

for the consumer. These models will start playing a role of

a steam locomotive; the sales of other models in the same

line-up will rise as well. Similar tactics was used by Nokia

in Q1 of 2003, however it lead to a crisis, a lot of small

distributors who don’t have direct contacts with Nokia

had material losses.

Nokia’s position on the Russian market was partly

saved because of the growing phone replacement market (people

buy new phones instead of the their old ones more often).

This market’s segment became 2x times larger during

the year 2003. The maximal size of the replacement market

for Moscow was observed in December, it was about 24 percent.

It is necessary to take into account annual splash of interest

for expensive phones, it usually occurs by the end of the

year. But even without looking at the last month, overall

growth of the market became nearly 2x times bigger. However

it’s only related to Moscow, if we take Russia in general

– the progress will not be so impressive, about 1.5

times bigger instead of 2.

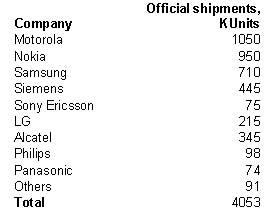

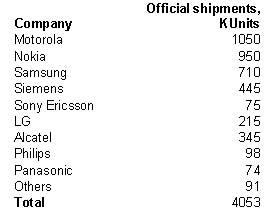

Some more words about Q4’s sales. Here are the results

of terminals shipping in Âîçâðàùàÿñü

ê ïðîäàæàì

êîìïàíèé

â ÷åòâåðòîì

êâàðòàëå,

ïðèâåäåì äàííûå

î ïîñòàâêå

òåðìèíàëîâ

â quantitative expression. We’d like to point

out that Alcatel’s high sales are closely connected

with successful cooperation with operators and that some of

the shipments were not counted during the previous periods.

We added them to this Quarter, and look what we’ve got

in the end:

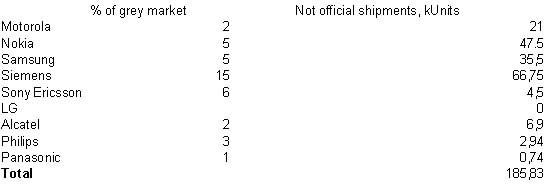

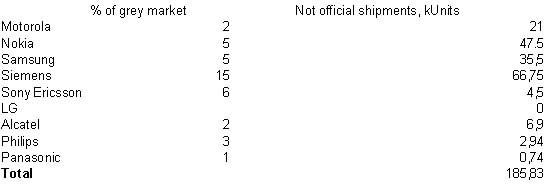

The grey market in the 4Q as well as in the 3Q was very

small. Shipments of exclusive models, really interesting for

customers but not officially announced have increased.

The volume of grey market in the 4Q was 4,5%. It is the

lowest value of the grey market for the last years. It proves

that mobile phones are demanded in Europe, really cheap models

are absent.

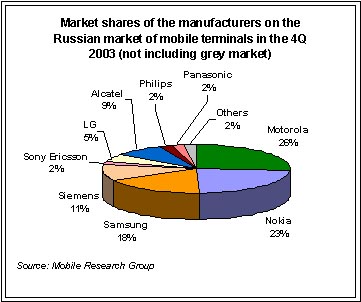

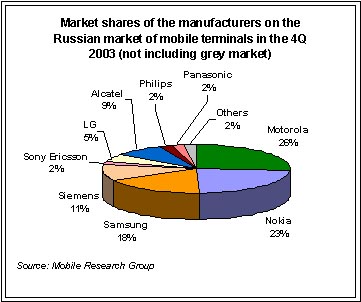

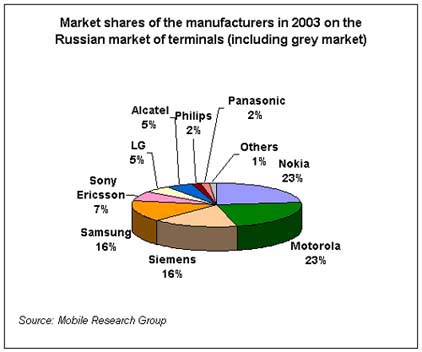

In the end of the year total market volume (including grey

market) was 15 million 117 thousand terminals. Market shares

of the companies are as follows.

During the last quarters Motorola was the leader of the

market concerning number of shipped terminals. At the same

time Nokia had very stable positions and the success of Motorola

didn’t affect alignment of forces. Now the companies

have equal shares (the difference in 14 500 terminals is not

significant (the data include grey market!)). If the same

scenario continues next year, Nokia could stop be the leader

of the market. The company needs more low-end solutions. The

share of cheap phones on the Russian market is constant and

it will decrease in the end of the 3Q 2004.

Samsung continues to increase its sales. During the year

the company showed impressive results. Now the company occupies

16% of the market, the same share has Siemens. During 2003

German manufacturer was losing its market share due to several

reasons. The main one was lack of terminals.

Forecast for 2004

Basing on market dynamics it is possible to say that the

market will continue to grow in 2004. Mobile Research Group

estimates market of terminals in 2004 as 21,5 million. It

is an average estimation taking into account favourable macroeconomic

situation. Estimations of most vendors are about 18-19 million

of terminals. The situation of 2003, when not true forecasts

couldn’t allow some players to increase their sales,

may repeat again. In our opinion, the situation of the first

half of the year will develop according the classical scenario.

In spring the demand in the price segment of 150 USD and lower

will increase because people will go at the country to “ditches”.

The main shipments in the 1Q will begin in the middle of February,

the demand of customers will be satisfied in March. It will

be favourable conditions for overstocking. The development

of the situation will depend on the actions of the main players.

If Nokia put prices for several models down, the crisis situation

of 2003 will repeat. If not, the market will continuously

grow till the end of the year, the greatest sales will be

in the 4Q.

The struggle for the first place on the Russian market

of terminals will continue in 2004. Motorola is a favorite,

because it has a big potential for growth: strong positions

in the low-end segment, absence of expensive models in 2003…

Samsung is also a serious competitor for Nokia, because it

has products in the same segments. In the end of the first

half of the year Samsung will overpass Siemens (now the difference

is 75 000 of terminals in favour of Siemens). Speaking about

money volume, Samsung maintains the lead positions. In our

opinion in the end of 2004 the company could occupy the second

place by number of terminals and the first place by proceeds.

It will depend on Nokia’s strategy on the market.

About Mobile Research Group

The main activity of Mobile Research Group (http://www.mobile-analytics.ru)

- is mobile terminals market researches in Russia. The company

analyses the competitive situation of all mobile phones manufacturers

available on the Russian market, and researches retail and

wholesales of mobile terminals. Basing on analyzed statistic

data the company makes a forecast of the mobile terminals

market development for some period (up to one year). According

to concluded partnership agreement once a quarter the company

presents a market analysis report, where the most considerable

events and their results are marked.

Publishing data contained in this press release

without a link to the Mobile Research Group as a source of

information is prohibited. We reserve the right to change

data published above if any new circumstances or new information

earlier unknown to us arise.

© Mobile Research Group, 2004

Eldar Murtazin (eldar@mobile-review.com)

Translated by Alexander "Lexx" Zavoloka(Lexx@i-5.delfi.lv)

Published — 30 January 2004

Have something to add?! Write us... eldar@mobile-review.com

|